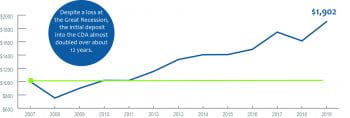

On Wednesday, January 31, U.S. Sen. Bob Casey of Pennsylvania introduced federal legislation to create a national children’s account policy. The 401Kids Act is designed to empower all children, and particularly children from disadvantaged households, by providing a means for them to accumulate assets for developmental priorities like higher education.

Informed by CSD research, 401Kids Act introduced in U.S. Senate