The Oklahoma Native Assets Coalition Inc. (ONAC) has released its Native Children’s Savings Initiative in the United States report.

Christy Finsel

ONAC executive director Christy Finsel, an enrolled tribal citizen of the Osage Nation and a Brown School MSW graduate, wrote the report. While at the Brown School, Finsel worked on the Native Assets project with the Center for Social Development (CSD) and the Kathryn M. Buder Center for American Indian Studies.

The report highlights native children’s savings initiatives, including Children’s Savings Accounts (CSAs)—also known as Child Development Accounts—in American Indian, Alaska Native and Hawaiian Native communities.

Moreover, it provides information about such initiatives’ benefits; addresses the major challenges designing and implementing such initiatives; and provides a historical timeline of Native children’s savings initiatives, including tribal minor’s trust accounts. Such accounts have existed as universal accounts administered by various Native nations since the 1970s, as well as tribal youth Individual Development Accounts (IDAs) and CSAs.

Like many other communities of color, Native communities face political, structural and cultural barriers and inequities; higher incidences of poverty and geographical isolation; nominal access to legitimate financial institutions; and low levels of philanthropic giving.

To address such inequities, Native CSAs can “…assist youth in accessing mainstream asset building accounts at banks or credit unions, strengthening savings habits and creating a nest egg of savings for a variety of current and future development purposes,” writes Finsel.

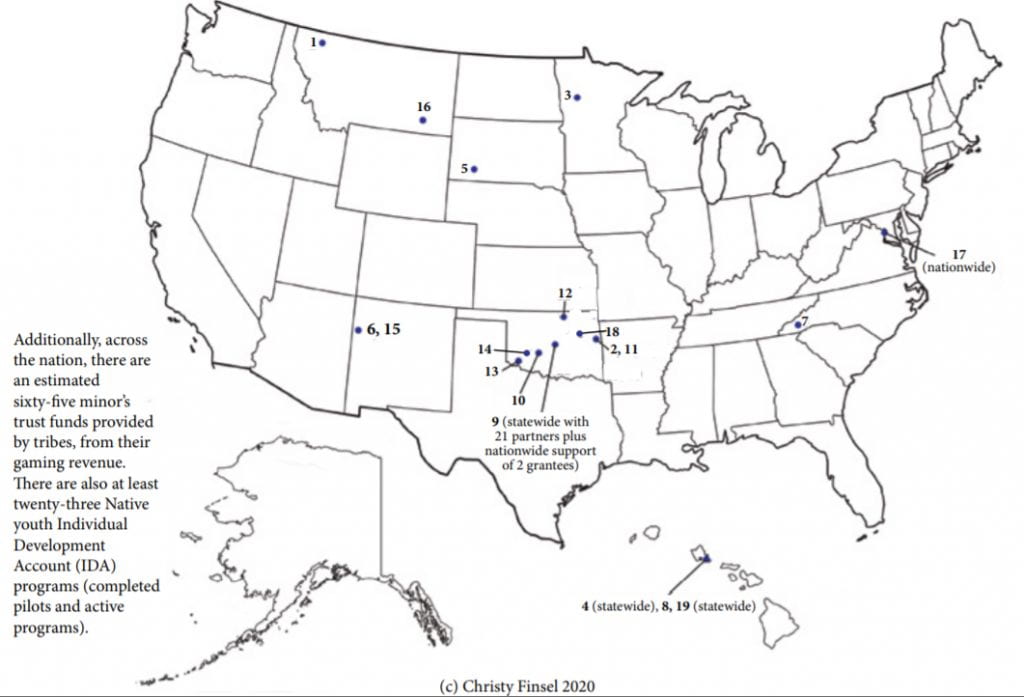

ONAC administers the largest American Indian-led seeded CSA program in the country, funding 932 accounts to date. The report identifies 19 Native CSAs nationwide, as illustrated in the map below.

Native Children’s Savings Initiatives

The report explores how Native-focused children’s savings initiatives are designed to be culturally relevant to meet the specific needs of tribal youth. It provides key factors to consider where to hold CSA funds. Finally, the report offers informed policy recommendations for advancing the development and implementation of Native children’s savings initiatives.

Such recommendation include allowing asset goals for Native youth that are responsive to their educational, cultural and tribal community; promoting and obtaining available state and/or federal CSA support for Tribal- and Native-led nonprofit administration of Native CSAs; establishing a continuum of options to meet the funding needs of Native CSA initiatives to allow for greater impact and sustainability goals; and more.

For more information, read the report and visit ONAC’s website.

The coalition’s history

ONAC has existed since 2001, after CSD and First Nations Development Institute held a meeting to determine interest in the development of an intertribal consortium or coalition of tribes that had or were about to start asset-building programs.

From 2001 until 2006, Karen Edwards (Choctaw), a project director at CSD at the time, worked with Native asset-building practitioners in Oklahoma to build the base for the coalition. By 2006, ONAC was in a fiscal sponsor relationship with FNDI. With support from the Ford Foundation, FNDI paid Edwards as a consultant once she left CSD to become ONAC’s project manager. In 2007, a group of tribal representatives met in Tulsa and agreed to become an organized Native-focused asset-building group. Edwards retired in 2011 and Finsel has served as the director since that time. The Internal Revenue Service classified ONAC as a 501(c)(3) in 2014.

As part of the four asset building programs that ONAC administers, ONAC hosts an annual Native asset building conference. In June 2018, CSD director Michael Sherraden was the keynote speaker. Sherraden’s research led to the development of Individual Development Accounts and Child Development Accounts.