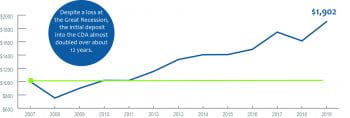

A group of experts and researchers is making the case for a nationwide Child Development Account (CDA) policy. The group, which includes CSD Founding Director Michael Sherraden and Policy Director Margaret Clancy, recently released the outline in a pair of CDA policy briefs. The briefs are entitled “The Case for a Nationwide Child Development Account […]

Prominent Child Development Account experts outline a nationwide policy