Shapiro and his team have spent 12 years following the lives of 187 families in St. Louis, Boston and Los Angeles.

‘Toxic Inequality’ author Shapiro shares insights from 187 families

Shapiro and his team have spent 12 years following the lives of 187 families in St. Louis, Boston and Los Angeles.

Newly elected Missouri State Treasurer Eric Schmitt kicked off the June 20 Child Development Account Forum by saying his office is “very focused” on the Missouri MOST 529 College Savings Plan.

“Financial capability and asset building” is the theme of the 60th anniversary issue of Social Work. Articles by several researchers at the Center for Social Development were published in the October 2016 issue of the flagship journal of the National Association of Social Workers.

On August 18, the Center for Social Development received the College Kids Ambassador Award from the St. Louis Treasurer’s Office of Financial Empowerment.

More than 60 people from 10 states and the District of Columbia participated in the “Child Development Account Forum” on August 16 at the Brown School.

“What It’s Worth: Strengthening the Financial Future of Families, Communities and the Nation” includes 40 essays by the nation’s leading experts on economics, financial services, public policy and philanthropy from across a broad range of sectors.

The U.S. Department of the Treasury has announced the national launch of the myRA program, a government-backed retirement plan for people who don’t have access to a retirement savings plan at work or who haven’t found an easy enough way to save.

In 2010, researchers in the vast YouthSave Initiative started investigating whether low-income youth can build savings in the developing countries of Colombia, Ghana, Kenya and Nepal. Now their findings are summarized in a newly released report.

More than 100 people gathered in St. Louis in October to hear leading experts discuss the latest research, funding, program and account-structure ideas in the growing field of Child Development Accounts.

YouthSave researchers gathered recently in Washington, D.C., to discuss what they learned over five years about how to provide scalable saving mechanisms to low-income youth—and what their findings could mean for youth development and financial inclusion.

The Ferguson Commission in its report released this week called for universal Child Development Accounts that are statewide and automatic.

In the United States, the largest Child Development Account (CDA) programs have been built on existing college savings plans, often called 529 plans after the relevant section of the Internal Revenue Code.

People in the field of social work are crucial to broadening how to think about the poor and their financial decision making, Camille Busette, PhD, said in the keynote speech at the 2015 Convening on Financial Capability & Asset Building: Advancing Education, Research, and Practice in Social Work.

The Great Recession exposed the financial fragility of millions of American families. Now researchers and policymakers are striving to improve the next generation’s grasp of personal finance and its access to safe financial products.

While many Americans took a big financial hit during the Great Recession, homeowners were less likely than renters to lose very large proportions of their wealth, finds a new study from the Center for Social Development in the Brown School at Washington University in St. Louis.

Many of the 40 million older adults in the United States are struggling financially. They lack the assets to see them through their later years, when they require more health care and other services than they expected.

Rhode Island’s treasurer and governor-elect, Gina M. Raimondo, on Dec. 10 announced a policy change to make college savings more accessible for newborn children in that state. In January, it will be as simple as checking a box.

Asian scholars, practitioners and policymakers share lessons about asset-building policies in Asia and chart the future in the new book “Asset-Building Policies and Innovations in Asia.”

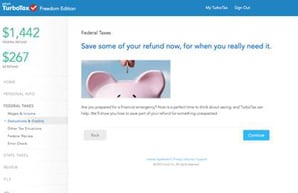

The 80 experts attending the event were brought together by a common interest in creating strategies for using the “golden moment” of tax time to help Americans build savings by changing the way consumers make economic decisions.

Michal Grinstein-Weiss, Ph.D., the associate director of the Center for Social Development and associate professor at the Brown School at Washington University, presented to a visiting delegation of Israeli government officials in New York City.

“Financial Capability Practice” — a course based on the Center for Social Development’s new Financial Capability & Asset Building curriculum — begins in January at the George Warren Brown School of Social Work.

The U.S. Treasury Department has awarded a $1.08 million research contract to the Center for Social Development at Washington University’s Brown School. One of 11 contracts awarded nationally under the Financial Empowerment Innovation Fund, this award will fund research on myRA accounts (“My Retirement Accounts”).

The Center for Social Development (CSD) at Washington University in St. Louis recognizes that asset-building policies in Asia offer important lessons in lifelong wealth and retirement security. International interest in these policies, particularly regarding aging populations, has prompted a book published in Chinese and one forthcoming in English.

One of the world’s leading social entrepreneurs believes a college education has a “multiplier” effect. Students learn material through coursework, and then go out into the world and apply that knowledge, in turn helping and teaching others.

More than two decades after Michael Sherraden, PhD, wrote Assets and the Poor – introducing asset building as a new social policy framework – that idea has taken off in numerous directions.

This week, the state of Maine became the first in the United States to make college savings for newborns universal and automatic, putting into practice research pioneered by Michael Sherraden and the Brown School’s Center for Social Development at Washington University in St. Louis.

February 25, 2014, Washington, DC

As the 2014 tax season opens, the Refund to Savings initiative continues with adjustments designed to better understand consumer savings behavior and help more Americans build savings.

A college savings account in a child’s name not only gives parents hope for the future, it also results in improved social-emotional health for their children.

More than 160 people attended “Generation Debt: the Promise, Perils and Future of Student Loans” at the Federal Reserve Bank of St. Louis on Monday, Nov. 18. The conference was co-sponsored by the St. Louis Fed and the Center for Social Development in the Brown School at Washington University in St. Louis.

As the financial roller coaster continues, those working to close the wealth gap and achieve economic security in the South are working more vigorously than ever.

Low-income youth in developing countries will save their money in a formal account when given the right opportunity.

Financial capability is central to the success of individuals, families and communities, yet social workers and other human service professionals are often ill-equipped when addressing such issues with financially vulnerable clients.

Financial issues impacting families are receiving renewed attention and interest by scholars, practitioners and students. Unfortunately, social workers and other human service workers often lack preparation, knowledge and skills to tackle increasingly complex financial problems facing their clients.

As taxpayers make the final push to file before the April 15 deadline, they often have visions of refund checks and plans to spend their windfall. But the question that more and more people are asking is, “How can I make the most of my refund?”

March 6-7, 2013, St. Louis, Missouri

Researchers and practitioners from around the globe met at the Brown School at Washington University in St. Louis this week to make strides toward increased financial awareness of children and youth.

The 2013 tax season has officially launched, and there is a 75-percent chance taxpayers will be eligible for a refund. What would it take to get them to save most, or all, of that money?

When every dollar is spent on necessities like diapers, gasoline and utilities, saving for college may be the furthest thing from a new parent’s mind. Mothers participating in a research study, however, suggest that a college savings account with $1,000 makes them feel optimistic about their children’s postsecondary education.

Grinstein-Weiss is a nationally and internationally recognized expert in the field of asset building whose research focuses on developing programs and policies to promote economic and social development of vulnerable groups.

The U.S. Department of Education (DOE) recently launched the first large-scale test of college savings accounts when it incorporated a college savings and financial counseling component into GEAR UP (Gaining Early Awareness for Undergraduate Programs), its initiative to prepare youth for college.

The Conference on Lifelong Asset Building: Strategies and Innovations in Asia, taking place this weekend in Beijing, will harness the experiences and brainpower of leading scholars, policy makers, practitioners, corporate leaders and funders from around the world.

Representatives from the Center for Social Development at Washington University recently traveled halfway around the world to meet with colleagues from the YouthSave Consortium, and had the unique opportunity to talk with Nepalese youth and learn more about their savings experience.

Do Ghanaian youth have money? How do they get it? What do they do with it? These are questions we are beginning to answer in YouthSave using data from a baseline survey of over 6,000 in-school youth.

Asset-building scholars, policymakers, and foundations gathered earlier this month in Washington, DC to celebrate the 21st anniversary of “Assets and the Poor: A New American Welfare Policy.”

April 17, 2012, St. Louis, Missouri

Sheldon Garon, the world’s leading historian in “popular savings” initiatives such as postal savings, will speak and answer questions at Washington University on Thursday, April 26th from 3:00 to 4:30 pm.

The Center for Social Development at Washington University’s Brown School will host a Symposium on International Research and Innovation on April 17, 2012, to examine the process and experiences of building international research partnerships and highlight innovations in economic empowerment and financial inclusion in international settings.

Jonathan Mintz, Commissioner of the New York City Department of Consumer Affairs, will deliver a lecture, “Developing Financial Capability in New York City,” on February 22 at the Brown School.

In Assets and the Poor, Michael Sherraden, PhD, the Benjamin E. Youngdahl Professor of Social Development at the Brown School at Washington University in St. Louis, writes that asset accumulation is structured and subsidized for many non-poor households, primarily via retirement accounts and home ownership.