The 2013 tax season has officially launched, and there is a 75-percent chance taxpayers will be eligible for a refund. What would it take to get them to save most, or all, of that money?

Researchers at the Center for Social Development (CSD) at the Brown School at Washington University in St. Louis will be looking for answers to that question during this tax season with the rollout of the Refund to Savings Initiative.

Refund to Savings is the largest savings experiment ever conducted in the United States, and it is expected to reach almost 1.2 million households within the next few months. The project is a novel collaboration of university researchers and a corporate partner in the tax-preparation industry.

Michal Grinstein-Weiss, PhD, associate director of the CSD, is leading the research team, along with Dan Ariely, PhD, the James B. Duke Professor of Behavioral Economics at Duke University. Intuit Inc., the maker of TurboTax software, Quicken Books and Mint, is partnering in the initiative.

This groundbreaking project is ushering in a new way of doing research. The Refund to Savings experiment not only will involve a huge sample size, it will be woven into the popular, user-friendly TurboTax software, making the rigorous research unique because it will test actual behaviors in real time.

“This is taking research to a new level,” Grinstein-Weiss says. “We are combining academic research with corporate know-how to come up with potentially a real solution that encourages savings.”

Refund to Savings researchers already have learned that when it comes to savings, factors beyond the taxpayers’ balance sheets need to be considered, and they have turned to behavioral economics in an effort to change behaviors. For example, even though most taxpayers say they intend to save a portion of their refund, few carry through on their intentions.

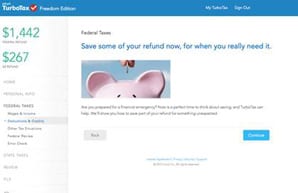

To overcome this natural tendency to delay saving or not save at all, Refund to Savings researchers will use the “golden moment” – the instance when taxpayers learn of their refund amount but don’t yet have the money in their hands. At this point, the Refund to Savings experiment will show the tax filer one of seven randomly selected motivational messages designed to prompt taxpayers to put a portion of their refund into a savings account.

These motivational prompts include saving for emergencies, their families or their future. Each motivational message also suggests a different savings-to-spending ratio. The suggested savings amounts are critical, because research indicates that people save more when a higher amount is suggested. The saved portion can be automatically deposited to an existing savings account, similar to the way refunds are already directed to taxpayers’ checking accounts.

In the months after refunds have been received, researchers will follow up with as many as 12,000 of the taxpayers who take part in the Refund to Savings experiment. The researchers will interview taxpayers to learn what motivated their decisions in choosing a savings-to-spending ratio, and whether their decision to save had an impact on household finances.

Grinstein-Weiss says American families have reached a near-historic low rate of savings, which places families at great risk for financial disaster when faced with sudden job loss or an unexpected expense.

“The low saving rate in American households has placed people at all income levels at risk of financial insecurity and of slipping down the economic ladder,” Grinstein-Weiss says. “A recent study by experts at Harvard and Princeton universities found that almost half of American households could not find $2,000 within 30 days to pay an emergency expense.”

Intuit also is concerned about this low rate of savings, and is invested in helping its customers improve their financial lives. Intuit offered the TurboTax platform for the Refund to Savings Initiative because it is one of the most popular tax-preparation software packages in the United States, with approximately 22 million users every year. The Refund to Savings experimental program is seamlessly woven into TurboTax’s Online Tax Freedom Edition product, which is free for low- and moderate-income taxpayers.

The Refund to Savings partners anticipate that what they learn about motivation, opportunity and options for increasing tax-time savings will positively impact the wealth of American households and influence tax policy decisions.

If the 2013 Refund to Savings experiment proves to be a success, the Refund to Savings partners will work with the Bureau of Public Debt at the U.S. Department of the Treasury and the U.S. Internal Revenue Service to identify other ways to make tax-time an opportunity for American households to save and build financial security.

“Developing easy ways to help tax filers automatically save a portion of their refund is one of the most promising opportunities to increase financial security for millions of Americans,” Grinstein-Weiss says.