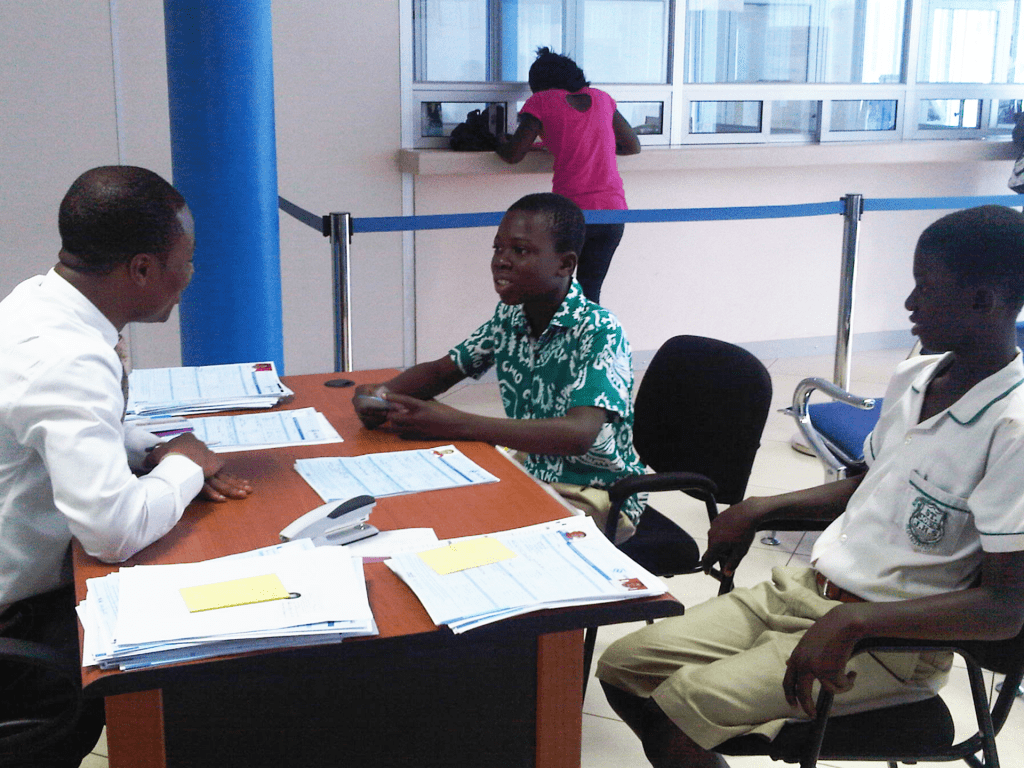

Mobile phones have become commonplace in sub-Saharan Africa. There, as in other parts of the world, financial technology has proliferated with the expansion of digital access, opening new doors to financial products and services. But this emerging landscape requires financial acumen, and sound guidance can be hard to find.

On July 15, a multinational group of partners gathered virtually to mark the launch of Financial Capability and Asset Building in Africa (FCAB Africa), a new collaboration aimed at meeting these needs. It will enlist financial-service providers and human-service professionals to improve the financial knowledge of disadvantaged populations as well as their access to sound financial guidance and financial services.

“FCAB Africa is a major new initiative to build financial capability and assets among families and communities on the African continent,” said Michael Sherraden in opening remarks. “This launch is a celebration of FCAB Africa and also a statement of vision, progress, and planning for the future.” Sherraden is the George Warren Brown Distinguished University Professor at Washington University and founding director of the Center for Social Development (CSD) in the university’s Brown School.

Vice President Mahamudu Bawumia of Ghana, in delivering the event’s keynote address, said, “Without doubt, evidence from research projects, such as those conducted under FCAB Africa, will be crucial in shaping future policy directions, making the establishment of the FCAB Africa both timely and necessary.”

The initiative is led by Dr. David Ansong and Dr. Moses Okumu. Ansong is Associate Professor and the Wallace Kuralt Early Career Distinguished Scholar in the School of Social Work at the University of North Carolina at Chapel Hill, and a Faculty Fellow with Global Social Development Innovations at the university. Okumu is Assistant Professor in the School of Social Work at the University of Illinois at Urbana-Champaign and a member of the adjunct faculty in the Department of Social Work at Uganda Christian University. Ansong and Okumu are both Faculty Directors at CSD.

Ansong and Okumu also are both Washington University alumni. Ansong served as a Research Associate at CSD while completing his doctorate and worked on the center’s earlier asset-based research projects in Africa before conceiving the new initiative. Okumu earned his master of social work degree from the Brown School.

In addition to CSD, the University of North Carolina at Chapel Hill, and the University of Illinois at Urbana-Champaign, the initiative includes partners from South Africa, Ghana, Kenya, Liberia, Uganda, Sierra Leone, and elsewhere on the continent. The partners celebrated the launch event as part of the 22nd biennial conference of the International Consortium for Social Development, a virtual gathering hosted by the University of Johannesburg’s Centre for Social Development in Africa, one of the FCAB Africa partners.

Ansong explained the collaboration’s approach and why financial service providers are central to it. “FCAB Africa will create comprehensive financial-development content, incorporating financial education, coaching, counseling, and many other helpful financial topics in existing financial services, including fintech platforms.”

“In this way,” Ansong said, “we think that mobile money, group banking, agent banking, and other financial services will serve as mechanisms for advancing financial literacy and inclusion.” He added, “The goal is sustainable change, and we hope to embed this in financial services within communities and online.”

Vice President Bawumia affirmed the need “to engage financial services” in broadening “financial stability, security, and the well-being.”

“As we recover from the pandemic and its associated economic costs,” Bawumia said, “everyone, especially the vulnerable families, will need access to the beneficial financial services and the knowledge and skills to make optimal financial decisions. Financial Capability and Asset Building in Africa has the vision to meet this challenge through building programs and policies that advance the well-being of all. We share this vision and call on all relevant stakeholders to engage and promote this laudable effort.”

Governor, Bank of Ghana

Bawumia is not the only Ghanaian policymaker to acknowledge a role for providers and the potential of digital finance. In prepared remarks, Ernest Addison, Governor of the Bank of Ghana, said, “Mobile money operations have promoted financial inclusion in the country, with a sizable portion of the unbanked population now roped into the formal financial system.”

Addison noted recent reforms that he said have shaped the terrain in Ghana by facilitating financial transactions across mobile money networks. The changes, he indicated, have lowered costs for consumers and improved service. He added, “Mobile money operators have developed microcredit and micro-insurance schemes that the financially marginalized can access to improve and sustain livelihoods.”

Representatives from the financial services industry have embraced the initiative’s goals. Patricia Sappor, President of the Chartered Institute of Bankers, Ghana, told event participants, “This collaboration will significantly and positively impact vulnerable households.” She added, “We are extremely thankful to the central Bank of Ghana, the ministry of finance, members of the Alliance of African Institutes of Bankers, and other institutions for coming on board to make this program a success.” The Uganda Institute of Banking and Financial Services is also a partner in the initiative.

Frontline workers and the financial lives of clients

The initiative’s central component involves equipping frontline professionals to share financial knowledge and guidance with the populations they serve. These professionals, the organizers noted, are uniquely positioned to help disadvantaged populations navigate the new financial terrain.

“Human-service professionals engage directly with people, and they develop trusted relationships,” explained Ansong. “FCAB Africa will equip these frontline professionals with basic knowledge and skills to empower vulnerable populations” through guidance on “budgeting, managing debt, accumulating assets, saving for retirement, and making many other financial decisions,” he said.

“Unfortunately,” Ansong added, “this potential is not being realized because human-service professionals are not currently trained with basic financial capability and asset-holding practices to support the economically vulnerable.”

Okumu emphasized that FCAB Africa’s offerings will be tailored for the contexts where the content will be delivered, saying that the initiative will collaborate “with communities to build a curriculum program that works for them.”

Dep. Vice-Chancellor (Academic Affairs), Uganda Christian University

The initiative emerges at an opportune moment. “COVID-19 changed everything, especially in terms of education on the African continent,” said Rev. Dr. John Mulindwa Kitayimbwa, Deputy Vice Chancellor for Academic Affairs at Uganda Christian University. “It has given us an opportunity to reimagine and rethink education.” He added, “We think that training students in financial capability and asset building is the right thing to do in Africa at this time.”

An endeavor grounded in insights from teaching and research

FCAB Africa grew out of the CSD’s research and teaching on financial capability and asset building, Sherraden told the event participants. The center’s work in the United States began with research by Margaret Sherraden and colleagues on models of financial functioning.

Through partnerships with minority-serving institutions of higher education in the United States, CSD researchers produced a curriculum and course materials for those schools. A textbook followed, spurring interest among social work educators and calls to add financial capability content to the curriculum used for training social workers in the United States. The American Academy of Social Work and Social Welfare recognizes the task of building financial capability and assets for all as one of 13 grand challenges for social work.

Asian nations have been particularly receptive to the center’s work on financial capability. “Singapore has already adapted an FCAB curriculum for social workers,” Sherraden said, “and mainland China is planning a large investment in FCAB training for social workers.” All of this work,” he said, “provides experience and lessons.”

“Countries in Africa can review and assess these experiences, and then chart their own FCAB Africa agenda,” Sherraden added. “Dr. Bawumia’s presence, along with other dignitaries and experts, underscores the importance and purpose of the FCAB Africa launch.”

“Now the actual work begins,” Okumu said in closing the event. “We look forward to collaborations as we work toward advancing financial capability and asset holding for all Africans.”